Do you know your wealth management fees?

The Math Most Firms Hope You Don’t Run

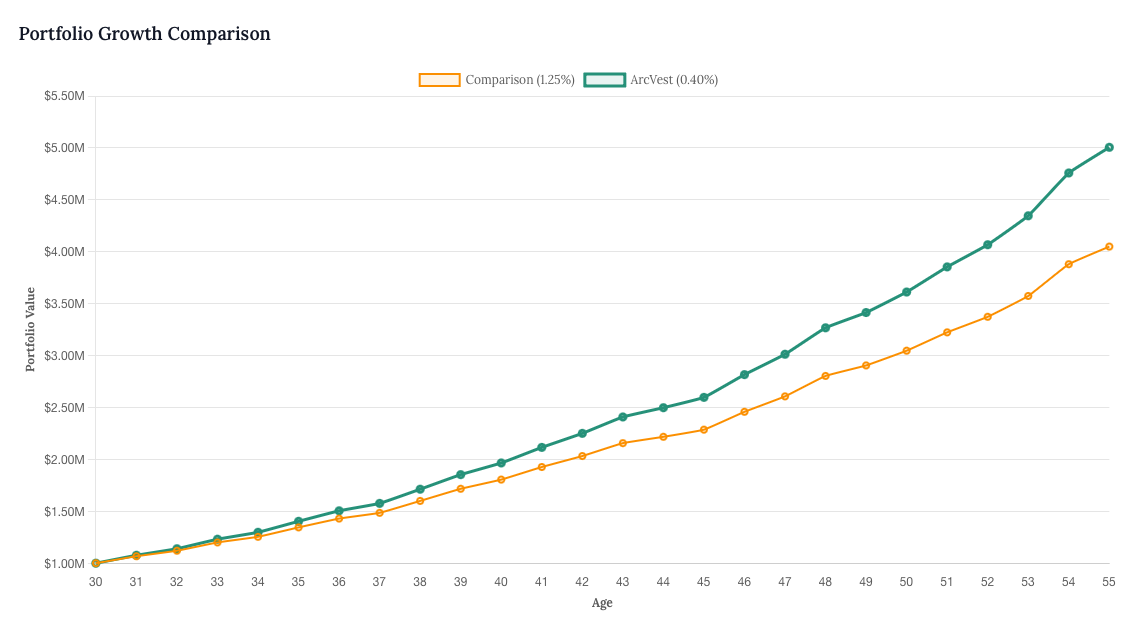

Let’s assume:

$1,000,000 invested

7% annual return

25-year investment horizon

0.40% Fee on $1M

Portfolio after 25 years:

$4,942,311

1.25% Fee on $1M

Portfolio after 25 years:

$4,045,846

1.30% Fee on $1M

Portfolio after 25 years:

$3,998,293

Fees are the only guaranteed negative return in your portfolio.

Reducing them is the only guaranteed positive outcome.

We believe:

Markets are competitive.

Costs compound.

Discipline beats complexity.

Transparency builds trust.

You don't need:

Expensive model portfolios

In-house funds

Layered wrap programs

Sales quotas disguised as advice

You need:

A rational asset allocation

Tax efficiency

Rebalancing discipline

Behavioral coaching

A fiduciary sitting on your side of the table

Join the ArcVest Wealth Strategy newsletter.

Sign up for the very best personal finance and investing information.